The Company Acquisition Landscape in Indonesia

Taking a look at Indonesia's largest company acquisition throughout the history

Indonesia was shook with recent news of its two biggest local owned startup Gojek and Tokopedia that announced a merger - referred as GoTo.

This news answered the long-awaited speculation of the fate of the two companies. In other news, there has been a speculation as well that GoTo is planning to make itself public next year, adding it to the list as one of the Indonesian company that made itself public like its e-commerce counterpart, Bukalapak

This merger or acquisition strategy it's not a stranger for any companies especially startups. Furthermore, acquisition becomes an exit strategy for any founder to receive a handful amount of fund to either start building a new startup or still be a part of the newly acquired company.

In this post, we're here to take a look at some of the biggest acquisition in recent history at Indonesia. The data was gathered from Crunchbase and it only catered the companies that has disclosed the amount of acquisition during the acquisition / merging process.

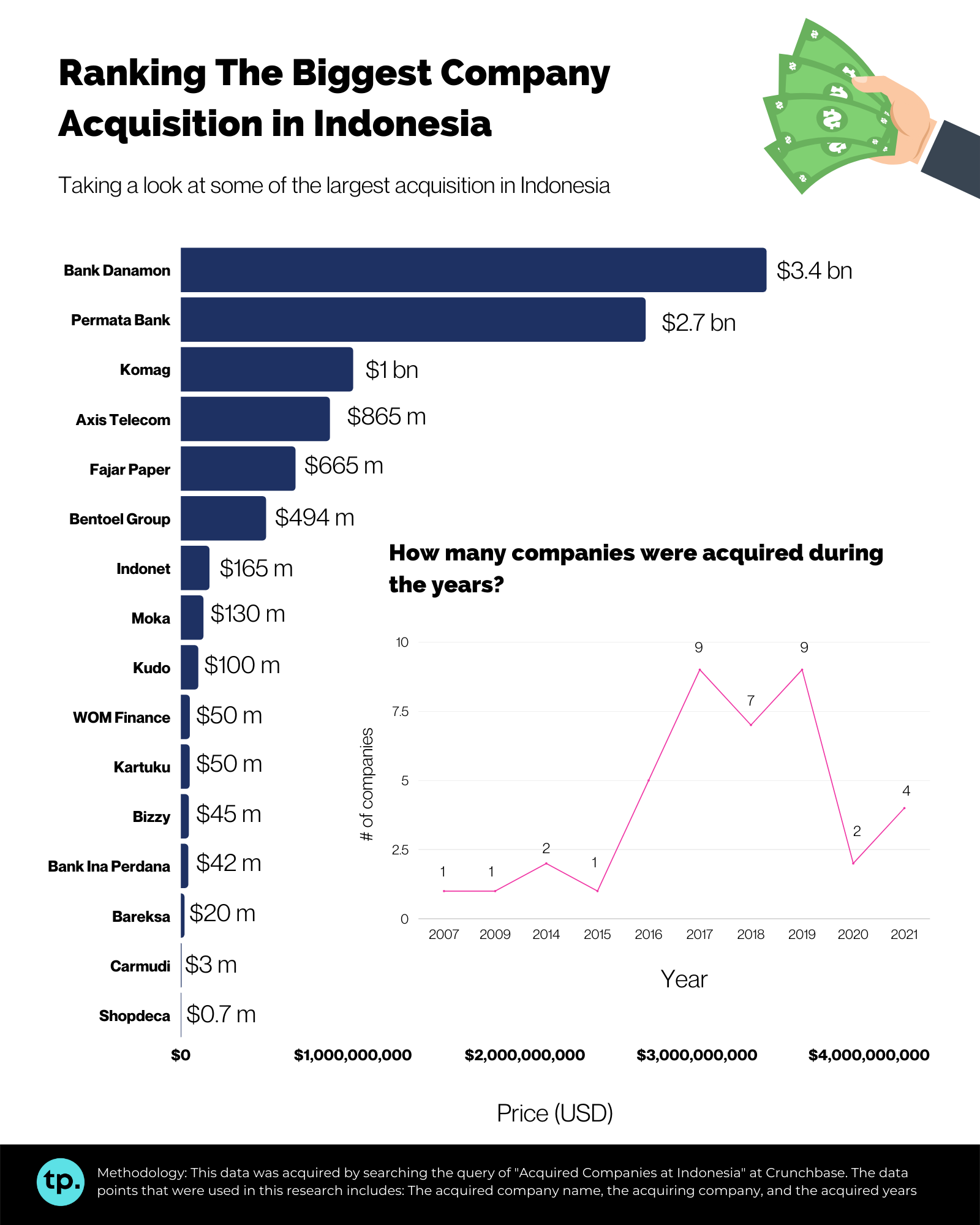

The Findings - Biggest Acquisition

Based on the data, here's the breakdown from each of the acquisitions:

| No. | Acquired Company | Acquiring Company | Acquisition Year | Price ($ million) |

|---|---|---|---|---|

| 1 | Bank Danamon | MUFG Bank | 2019 | 3,402 |

| 2 | Permata Bank | Bangkok Bank | 2019 | 2,700 |

| 3 | Komag | Western Digital | 2007 | 1,000 |

| 4 | Axis Telecom | XL Axiata | 2014 | 856 |

| 5 | Fajar Paper | SGC | 2014 | 665 |

| 6 | Bentoel Group | British American Tobacco | 2009 | 494 |

| 7 | Indonet | Digital Edge DC | 2021 | 165 |

| 8 | Moka | Gojek | 2020 | 130 |

| 9 | Kudo | Grab | 2017 | 100 |

| 10 | WOM Finance | RC Management | 2017 | 50 |

| 11 | Kartuku | Gojek | 2017 | 50 |

| 12 | Bizzy | Warung Pintar | 2021 | 45 |

| 13 | Bank Ina Perdana | Salim Group | 2017 | 42 |

| 14 | Bareksa | OVO | 2019 | 20 |

| 15 | Carmudi | iCar Asia | 2019 | 3 |

| 16 | Shopdeca | migme | 2016 | 0.7 |

Some interesting findings within those data are:

- Some of the local bank in Indonesia is already acquired by foreign bank ie. MUFG Bank (Japan) and Bangkok Bank (Thailand)

- Currently, those banks acquisition holds the largest amount of acquisition price compared to any other acquisition throughout Indonesia's history

- One of the notable acquiring company in the list is Gojek, which have spent around $180 million acquisition cost during their 10 years reign.

With those data in mind, the next step of the research is which company has the most acquisition in Indonesia, the data gathering method was similar with the previous one with the addition of filter by Acquirer Name.

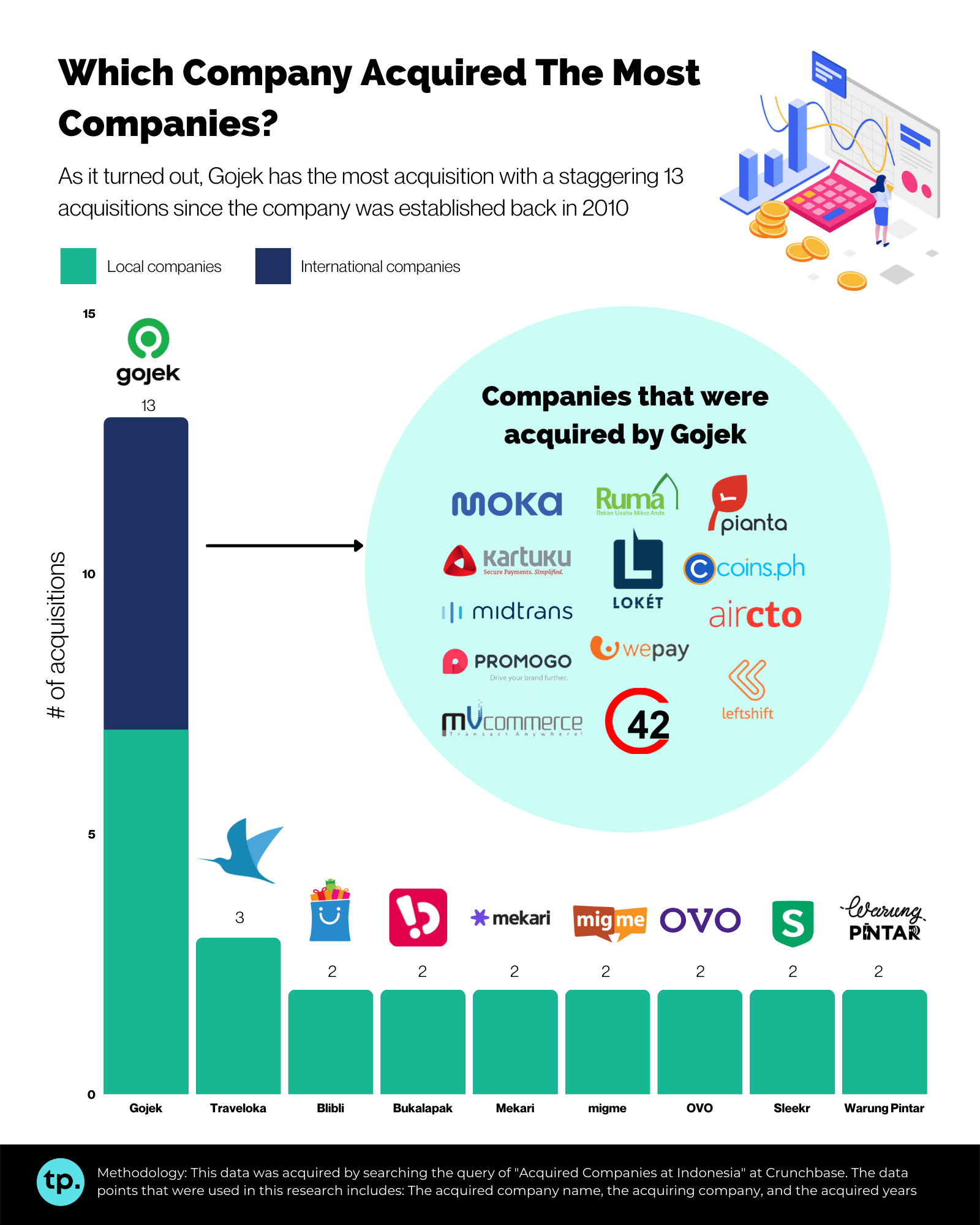

The Findings - Company with the Most Acquisition Activity

It goes without saying that based on the data, Gojek is the "king of acquisition" during their 10 long years of establishment in Indonesia. They have acquired 13 companies in total which the average company were able to secured 2 acquisitions.

What's interesting is it seems that Gojek is able to acquire not only big local companies, but they were able to acquire overseas companies as well such as Pianta (which is a health based startup from India), coins.ph (an e-wallet payment solution in Philippines), WePay (e-wallet from Vietnam), aircto, C42 Engineering, and Leftshift Technology that mainly focused on providing technical solutions.

The most notable one would be Moka, a cloud based POS system that was acquired by Gojek in 2020 with the price tag of $ 130 million, the biggest for the company to date.

The Benefits of Merger and Acquisition

Merger and Acquisition is one of the biggest and boldest strategy for any companies out there to reach the top. Companies have decided to do a merger / acquisition mostly because the additional resource both workforce and funds which lets them to grow and sustain for a longer period of time.

But what are the benefits of company acquisition? Here's some of them:

- Increased marketshare: With the power of two or more companies combined, they are able to increase their capability to capitalize on the market. One companies might excel in one market and the other on another market. When combined, they are able to capitalize both of the market.

- Access to talents: It goes without saying that acquisition often lead to more workforce. With that in mind, the newly merged company would have an abundance of talented people at their disposal

- Faster strategy implementation: With merger and acquisition, companies are able to adapt faster with what the market needs due to their additional resources. Timestrain rarely becomes an issue.

Summary

All in all, companies that is planning to acquire / merge with other companies should have a proper strategy and must be able to manage expectations. There has been many examples throughout history that acquisition brings more setbacks than it is bringing good for both parties.

Raw data: https://bit.ly/2WjJ1j2