The Companies That Recently Went Public: A Visualization

A visualization of raised money and valuation at IPO from some of the companies that went public from the last 3 months

It is said that there are only three outcomes for a startup: Acquired, Bankrupt (Exit), or Go Public.

Recent news in Indonesia shows that one of its biggest local startup - Bukalapak, that has been established for the last 10 years finally went public on August 2021.

This shows that Asian, especially South East Asian companies is ready to compete with other big companies in North America and Europe.

As a blog that focuses on giving insights and new knowledge to its readers, I've decided to wrote this piece to show my fellow Indonesians that local companies from Indonesia are able to compete internationally.

The Findings

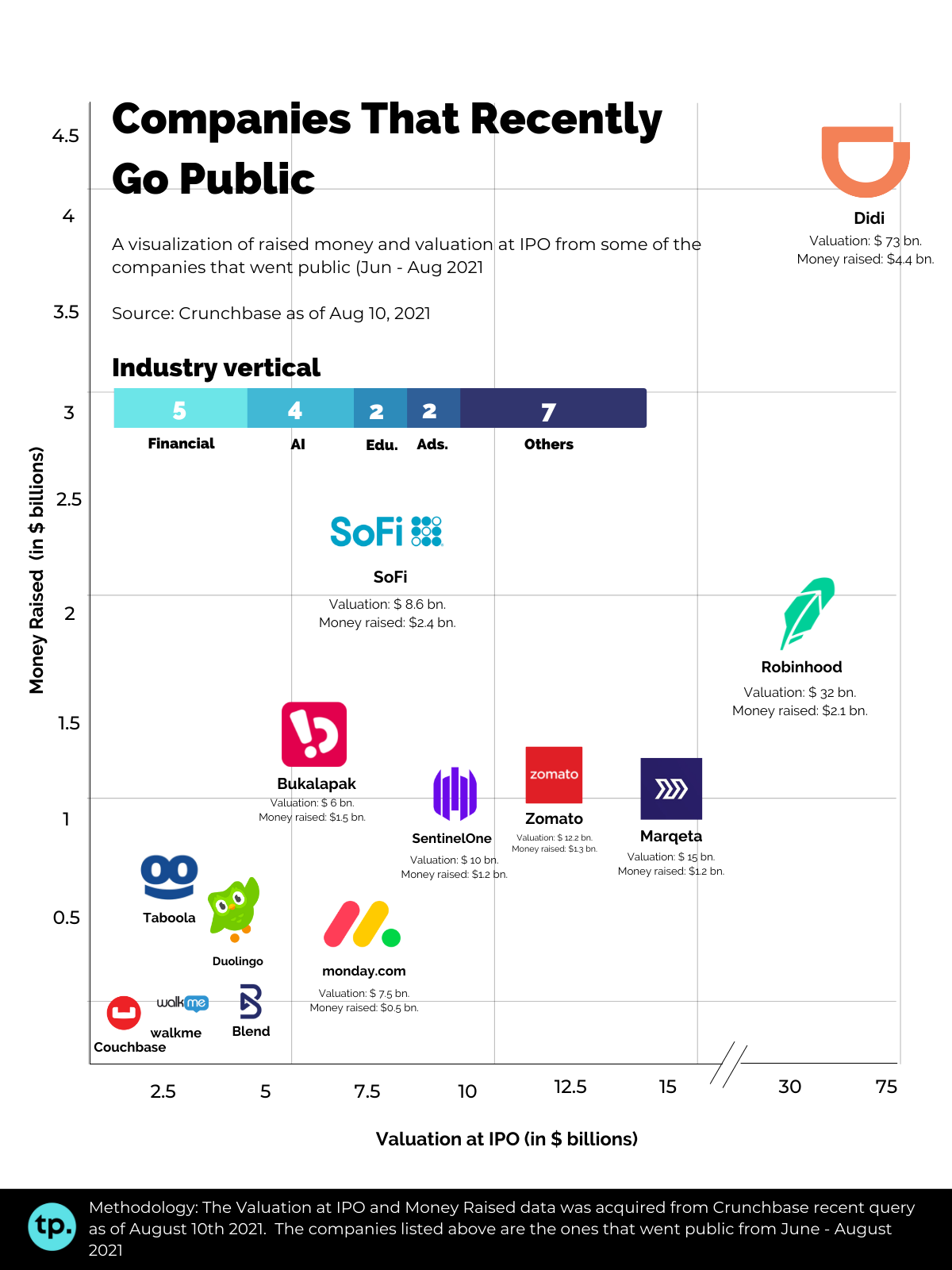

The data compared 14 companies that recently went public between the month of June to August 2021. The data was acquired through Crunchbase.

There are two key data points that are being compared, the Valuation at IPO and the Money Raised at IPO.

Simply put, Valuation at IPO means the estimated value of a company during its Initial Public Offering (IPO) which was done prior to the IPO itself by the team of analysts. Furthermore, as its name suggests, Money Raised at IPO means the amount of money that the company generates from the market share the day their stocks went public.

As you might have noticed, a bigger value at both ends means good news for the company. The last thing that you want is the opposite.

Based on the research, here is the result (Valuations and Money Raised is based on $ billions):

| No. | Company Name | Origin | Valuation at IPO | Money Raised at IPO |

|---|---|---|---|---|

| 1 | Didi | China | 73 | 4.4 |

| 2 | Robinhood | USA | 32 | 2.1 |

| 3 | Marqeta | USA | 15 | 1.2 |

| 4 | Zomato | India | 12.2 | 1.3 |

| 5 | SentinelOne | USA | 10 | 1.2 |

| 6 | SoFi | USA | 8.6 | 2.4 |

| 7 | monday.com | Israel | 7.5 | 0.5 |

| 8 | Bukalapak | Indonesia | 6 | 1.5 |

| 9 | Blend | USA | 3.9 | 0.3 |

| 10 | Duolingo | USA | 3.6 | 0.5 |

| 11 | Taboola | USA | 2.6 | 0.5 |

| 13 | Walkme | USA | 2.5 | 0.2 |

| 14 | Couchbase | USA | 0.9 | 0.2 |

The Insights

As we can see from the graph, that Didi (a ride-hailing platform) from China has the biggest valuation at IPO ($73 bn.) and the largest money raised with the total amount of $4.4 bn.

Didi still stands as the largest IPO in the year 2021.

Another notable find is there are several companies coming from Asia such as Zomato, Bukalapak, and monday.com that were also valued quite high compared to the other companies from the US.

Zomato was valued at $12.2 bn. , monday.com at $7.5 bn, while Bukalapak $6 bn. This indicates that tech companies in Asia have started to emerge and shows the other companies out there that they are able to compete.

Why IPO?

There are several benefits of making your company go public. It consists of:

- Fundraising

One of the most immediate effects that any company will feel after going public is the money. Since the company will receive additional funds from the public, it opens up more opportunities to gain more capital.

Companies may use an initial public offering to finance research and development, hire new employees, build buildings, reduce debt, fund capital expenditure, acquire new technology or other companies, or bankroll any number of other possibilities.

The money provided by an IPO is significant and can transform the growth trajectory of a company.

- Exit Opportunity

Every company has stakeholders who have contributed significant amounts of time, money, and resources with the hopes of creating a successful company. These founders and investors often go for years without seeing any significant financial return on their contributions.

An initial public offering is a significant exit opportunity for stakeholders, whereby they can potentially receive massive amounts of money, or, at the very least, liquefy the capital they currently have tied up in the company.

- Publicity and Credibility

If a company hopes to continue to grow, it will need increased exposure to potential customers who know about and trust its products; an IPO can provide this exposure as it thrusts a company into the public spotlight.

Analysts around the world report on every initial public offering in order to help their clients know whether to invest and many news agencies bring attention to different companies that are going public.

- Reduced Overall Cost of Capital

A major obstacle for any company, but especially younger private companies, is their cost of capital. Before an IPO, companies often have to pay higher interest rates to receive loans from banks or give up ownership to receive funds from investors. An IPO can lessen the difficulty of receiving additional capital significantly.

What do you need to prepare?

If you're considering an IPO, be prepared. It's time-consuming, expensive, and a challenging process. To ensure a better process, here are some things that you need to prepare prior to going public:

- Develop a strong understanding of your index

Any equity index comes with its own requirements. There will be common themes, such as audited financial statements, but there are specific costs, disclosures, corporate governance requirements, and more associated with each individual index.

Understand these before beginning the process at all. It will help you choose which index suits your company best and save you from missing something important when you’re already some way into the process.

- Put together your IPO team

A good team is as important for an IPO as it is for due diligence. You’ll need top-notch accountants, legal experts, underwriters, and probably some outside advisors specialized in IPOs before beginning the process.

A good place to start is with the experts on IPOs, who can talk you through the process, helping you understand who is going to be needed and when.

- Construct a board of directors

If your company was just about to make a transformative change in strategy, which could make or break its future, who would you go to for a second opinion on the strategy?

That’s the question you should be asking yourself when thinking about board members. These should include a mix of industry veterans with financial, operational, and strategy experience. Look especially for their accomplishments in the near past and sound them out about your ideas for the direction of your company to see if they’re a strategic fit.

- Get the timing right

Timing, just as with mergers and acquisitions, is all-important for IPOs. But be cognizant that there are two aspects to timing: external and internal. The market may be at the right moment, with liquidity abound, but your company may not be. The reverse is also true.

Experts in IPOS tend to believe that IPO being ‘internally’ ready is more important than the market, but there’s no rush here - mess up the IPO and you could do more damage than good.

- Preparing the roadshow

A good tip here is to underpromise and over-deliver: People don’t like nasty surprises further down the road, so keep it upbeat but don’t exaggerate your company’s growth prospects or it will come back to haunt you.

- Ongoing communications

Regardless of the size of your company, the role of investment analysts can be crucial, both before and after the IPO process. Establishing and maintaining good relationships with these analysts can be the difference between there being steady ongoing demand for your company’s stock and there being no liquidity at all in your equity.

Be communicative and helpful whenever they come calling. Good relations with analysts can generate significant long-term value for listed companies.

Conclusion

Going public can pose a challenge. As any company would, you need to prepare a lot of stuff during the process. So it is advisable to determine the purpose and review your financial statements before deciding to go forward with the IPO.

Sources