IPO as an Emerging Trend in Indonesian Startup

There has been numerous news about various companies in Indonesia going public. Is this the new normal for us?

In my previous article, I have compared many companies that have gone public in terms of valuation and the amount of money that they raised during their Initial Public Offering (IPO).

One of the most notable name was Bukalapak, making the first mark of Indonesian Startup that went public in the early August 2021 with the total valuation of $6 billion dollars.

Little that the public knows, a voucher aggregator platform called Ultra Voucher has also gone public, meaning that there are actually two startups from Indonesia that entered the stock market.

The following weeks we were bombarded with news about more companies that have plans to go public in the foreseeable future (read: early 2022).

With that in mind, let's take a look how much exposure that these companies received during the announcement. In this research specifically, there are four companies that is being compared: Bukalapak, Ultra Voucher, Blibli, and GoTo. Blibli and GoTo has become the latest companies that has announced their plans to go public.

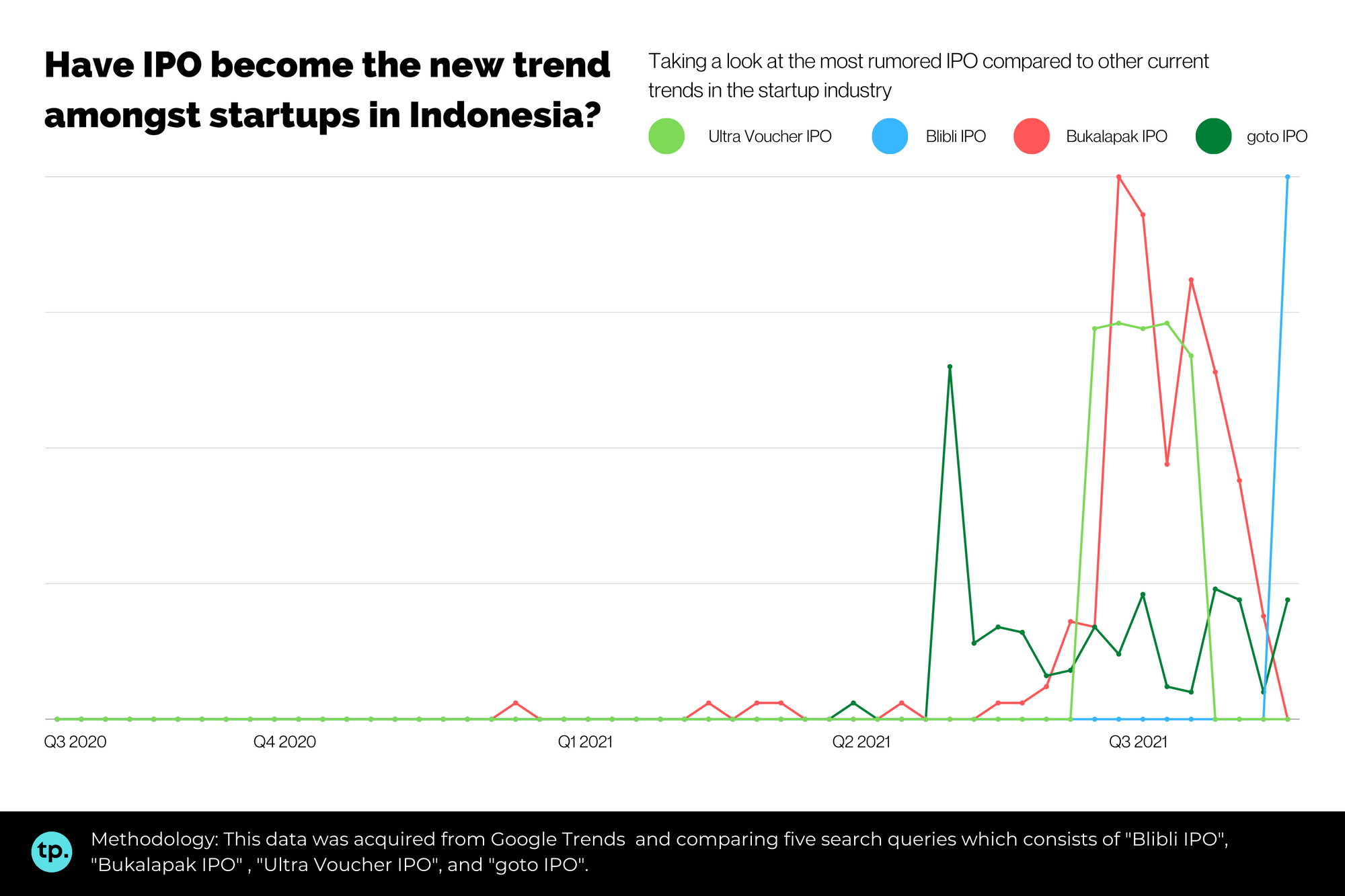

Based on the data of Google Trends, here is the result

The Findings - Which one is the most trending?

From the get go, we can already know that there has been some chatter of IPO since the beginning of the first quarter in 2021, but it is not until the second quarter that the chatter has become stronger.

Here are some of the interesting insights based on the Google Trends data:

- GoTo was one of the first companies that picked up a lot of chatter in the second quarter in 2021, right after their official merger announcement within the same period. Since then, GoTo was issued to announce their merger as early as the end of 2021.

- Bukalapak and Ultra Voucher experienced a spike in the beginning of the third quarter in 2021, following their official offerings in the same period. The two dominantly controls the trend until it gradually declines as the end of the month approaches

- Blibli, being the latest contender came up with the news of IPO in the last week of August and picked up a spike in the trend a few days later.

The Findings - Which one has the most coverage?

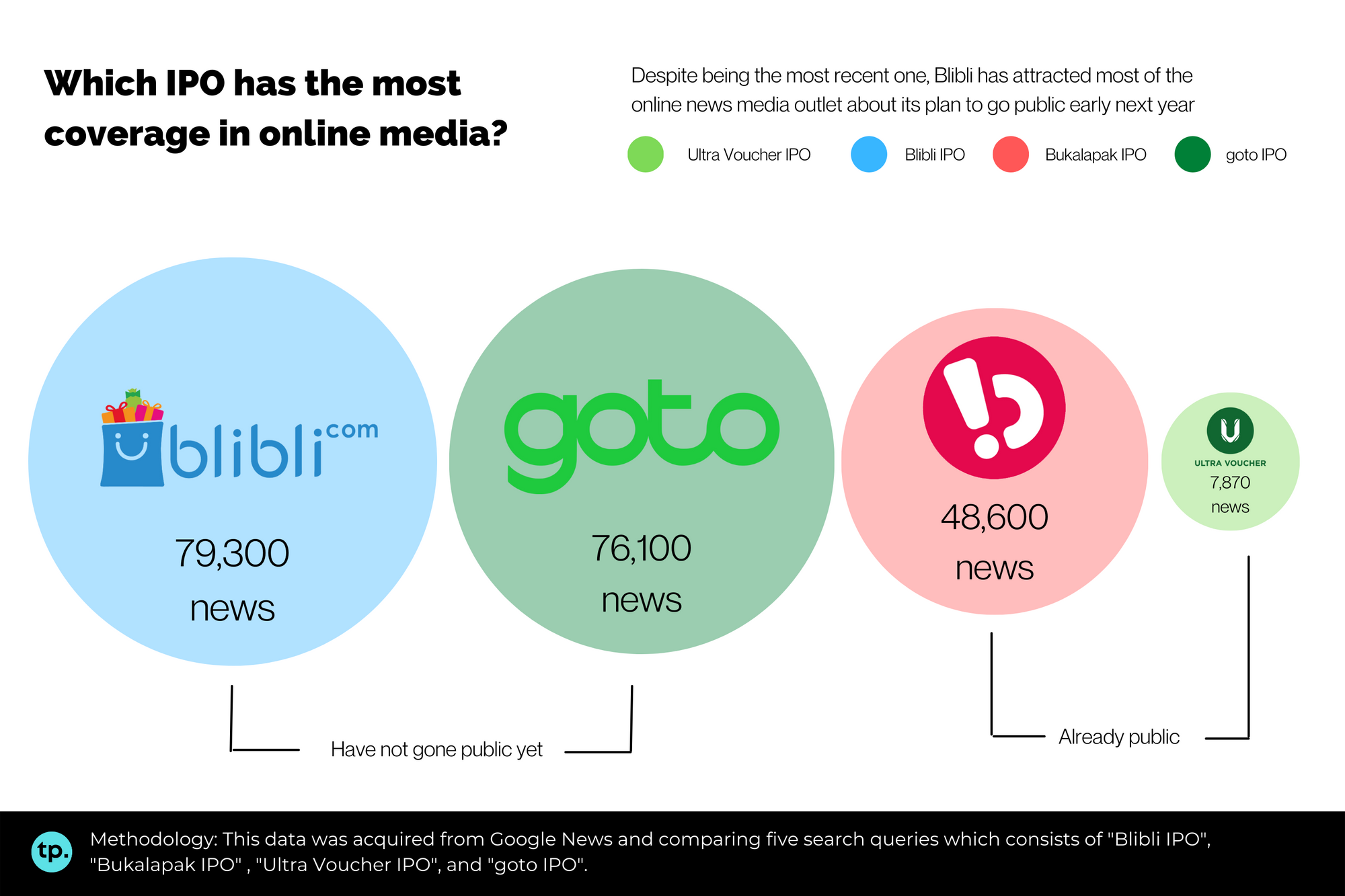

Other than using the Google Trends data, we could see how interesting these news are by looking at the number of news that actually covers the topics.

Furthermore, using the data from the Google News result, here are the data for how many online media covered each news. The news that is selected here has to at least contain the defined query.

The data from Google News shows some interesting findings about the IPO related news. Here are some of them:

- Blibli and GoTo have the most coverage with 79,300 and 76,100 online media coverage constantly. Those numbers are the largest despite the fact that they are not yet gone public.

- Blibli, the latest entry in the IPO space in Indonesia, shows the most media coverage, even though the issue has just been released in the last week of August - which is the shortest compared to the others.

- Bukalapak and Ultra Voucher, the first two companies that already went public, have managed to produce 48,600 and 7,870 online media coverage respectively, even though both of them have already went onward with their IPOs in August 2021.

IPO - Are we ready or just following the hype?

Indonesia has always been a green pasture of technological advancement especially in South East Asia, the population and the infrastructure has made this possible.

In the last 5 years, there have been over 100+ new startup companies (Source: Crunchbase) in Indonesia, this strengthen the fact that Indonesia is ready in terms of the technology and the man-power.

The last question remains, is IPO really the way forward for Indonesian startup companies?