The Growth of Digital Banking Service in Indonesia

Witness the emerging phenomenon of digital banks and how Indonesia sits between the mix

It goes without saying that everyone demands a more convenient way to do anything these days. Banking is no exception.

The importance of having bank account exceeds the needs of having a saving, emergency fund, or even a sense of security for the account holder.

It becomes a lifestyle of its own. Banking, what was once known as a rigid and procedural industry, now have become something that is convenient, easy, and flexible with the emergence of digital banking

By definition, digital banks can be defined as the financial institutions that have done a digital transformation or currently in the process of doing it. Digital transformation can be defined as the elimination of some / every on site process.

As an example, in the old days of banking, you have to go to your local bank branch to open up or account, or transfer money. Digital banking on the contrary, tries to eliminates those process and make banking experience more effective and efficient.

With that said, many financial institutions out there claimed themselves that they are a "digital bank" simply because they have an app. The case is not neceesarily true because the true essence of the digital experience itself is to eliminate those on site process. If a bank have an app but those process is still done manually, then they haven't gone through a digital transformation per se.

Many news have revolved around digital banking these past few months in Indonesia. Many tech companies players entered the digital banking industry. Thus, the race is on for these players to become the top of mind.

But who are the players of digital banking in Indonesia? How do they differ from each other?

This post will show how many digital banks are currently available in Indonesia and will also explain the state of growth for future players that wants to acquire new digital bank users.

The Findings - Digital Banking's Growth in Indonesia

Here's some interesting insights based on the findings:

- Jenius is the first digital bank in Indonesia with its emergence back in 2016.

- The trend of digital banking service continue to grow over the years, with more than new 5 banks in the past year (2020 - 2021), consists of local banks, regional banks, and tech / fintech companies.

- Indonesia have become a 'green pasture' of financial services. As of now, there are 15 digital banks available in the country.

The data that was provided seemed to speak for itself, with 15 digital bank services available, the competition now becomes more fierce and it is more important than ever to make the experience as seamless as possible for the users.

As you might have noticed, since UX (user experience) becomes one of the priority for these digital banks, it goes without saying that their main target is the younger audience. According to Momentum Asia, there are 5 key reasons on why these banks are targeting younger audience:

- Younger generations are tech savvy. This will lower the education cost for new users when they use the app.

- New earning power and even more desires. Younger generatons tends to have more in their bucket list, this will trigger more transactions from them.

- New banked population. This will ensure higher customer lifetime value.

- Older people are more stubborn, making them harder to convert.

- FOMO (Fear of Missing Out). Other players are also targetting younger customers.

The Findings - Indonesia's Bank Account Ownership

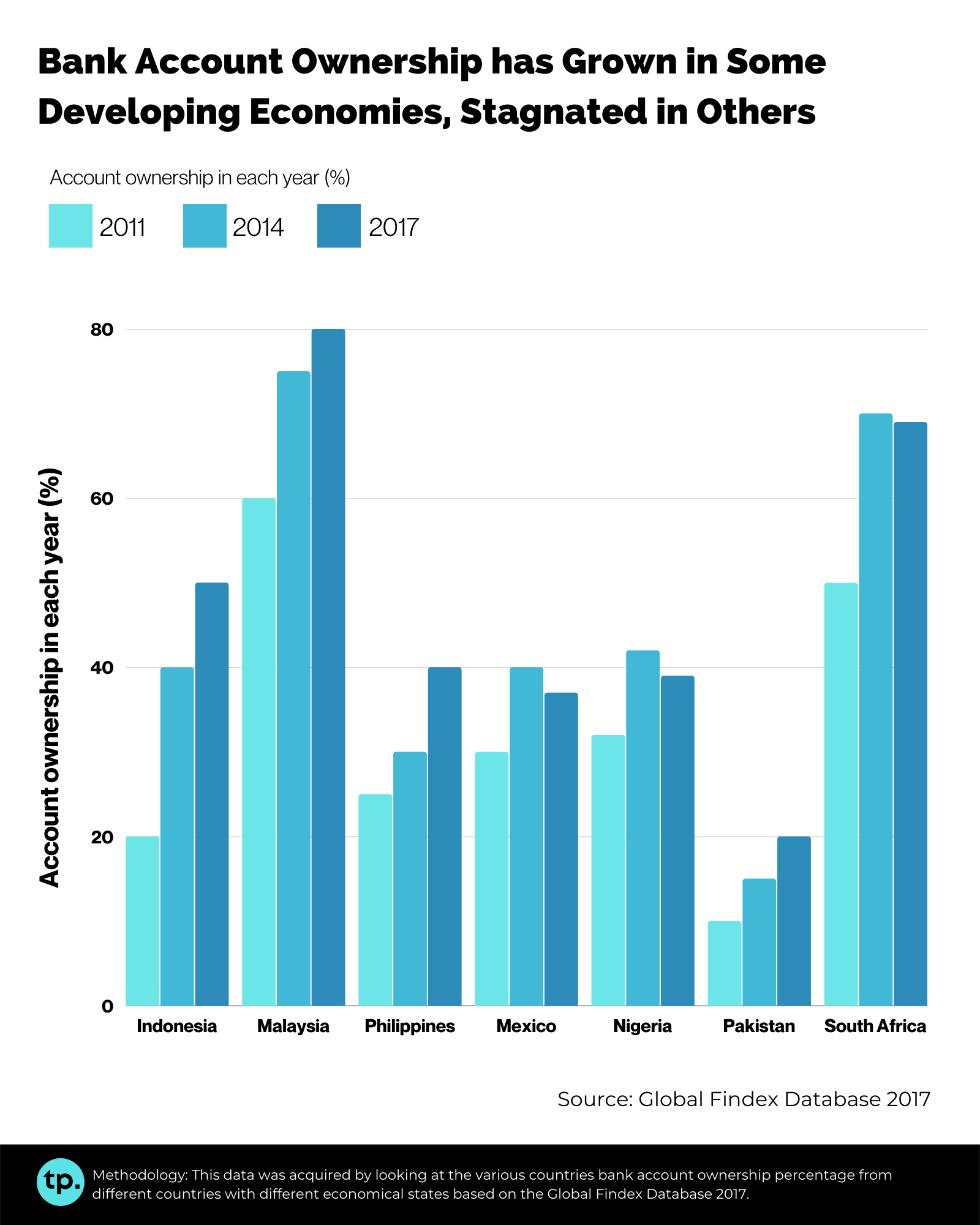

The following are the interesting findings regarding bank account ownership throughout multiple countries (based on the data from Global Findex Database 2017):

- In the last 7 years (2011 - 2017), Indonesia shows a significant growth of number of people that have a bank account. The number continue to grow from each 3 years period. From 20% in 2011 to approximately 40% in 2014.

- The country with the highest bank account ownership in South East Asia region belongs to Malaysia, with over than 80% of its citizen owns a bank account.

- Some of the countries shows a declined or stagnan growth, such as in Mexico, Nigeria, and South Africa

What the data tells is actually how much potential that Indonesia have in terms of digital banking penetration. With the exponential growth of bank accounts ownership in the last decade, it indicates a positive sign for the digital banks players out there to make their presence known into the public.

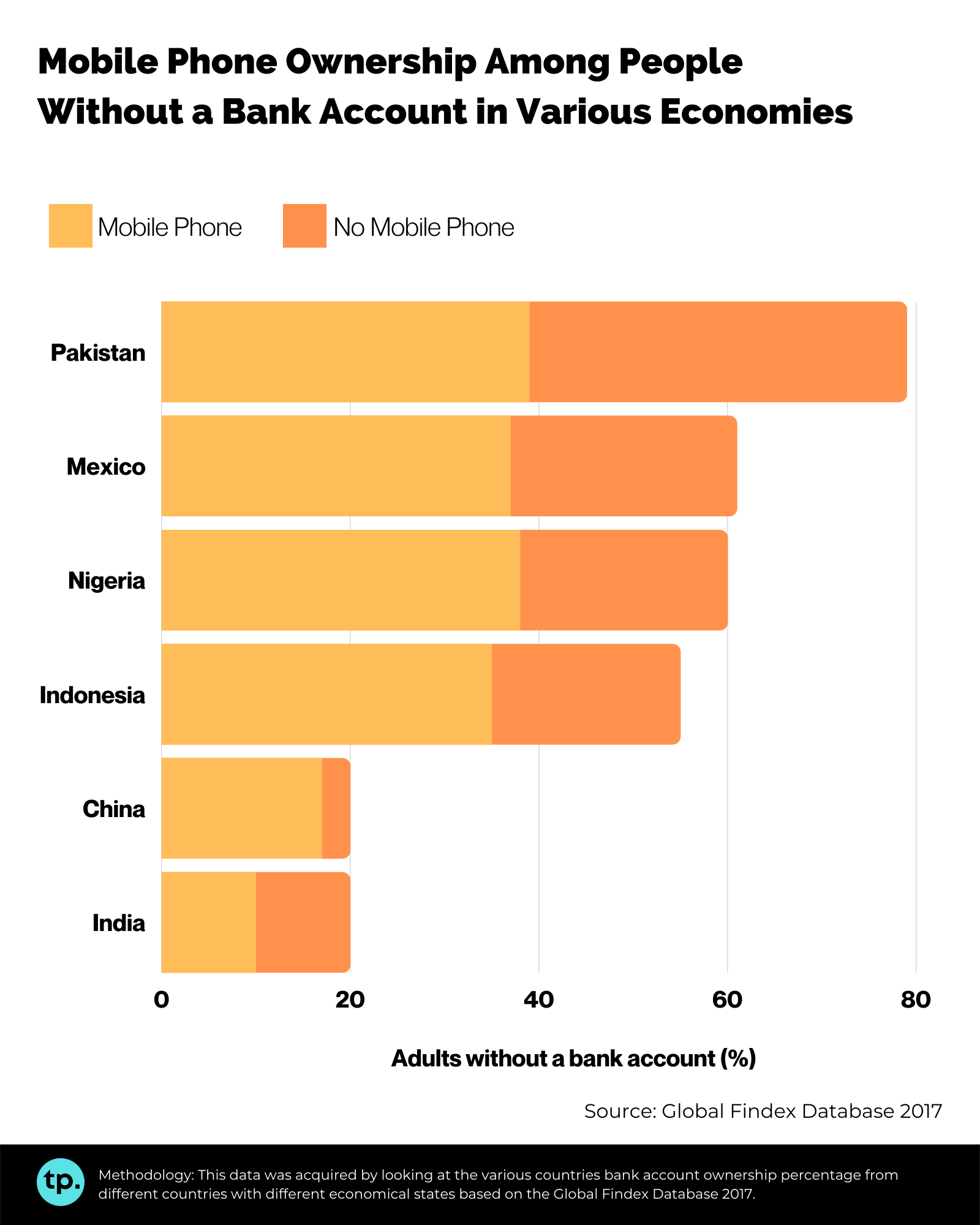

When it comes to digital banks, the usage of a mobile phone becomes inseparable throughout the experience. With this in mind, let's take a look on how much potential user that these digital banking platform can capitalize based on the number of people in Indonesia that is currently have a mobile phone but don't have any bank account

Based on the data from Global Findex Database , digital banks in Indonesia could increase the number of bank account ownership by almost 29%. This number came from the number of people that already have a mobile phone but no bank account yet.

Digital Banking - How the Future will Look Like for Indonesia

To sum up today's article, here some of my opinion regarding how the future of digital banking in Indonesia will look like:

- Digital bank will continue to become a trend. Even smaller banks wants to create this experience to keep their competitive edge.

- Maintaining customer experience is key. Retention should be the goal in the long run

- Everyone will target young, tech-savvy audience in major cities where most of the big spenders live.

- Tech companies will emerge as one of the big players in the digital banking area, competing with other large enterprise financial institutions